BROKERS CHOICE: CGCONSUMER, KALPTARUPOWER, SWIGGY, DATAPATTERNS, MAXFINA, TATAPOWER, PERSISTANCE

AHMEDABAD, 16 DECEMBER: અગ્રણી બ્રોકરેજ હાઉસ તથા ફંડ હાઉસ તરફથી પસંદગીના સ્ટોક્સમાં ખરીદી\ વેચાણ\ હોલ્ડ કરવા માટે ભલામણ કરવામાં આવી છે. તે રોકાણકારોના અભ્યાસ માટે અત્રે રજૂ કરીએ છીએ.

GS on CG Consumer: Maintain Buy on Company, target price at Rs 500/Sh (Positive)

Emkay on Kalpataru: Maintain Buy on Company, target price at Rs 1550/Sh (Positive)

JP Morgan on Godrej CP: Maintain Overweight on Company, target price at Rs 1365/Sh (Positive)

Axis on Swiggy: Initiate Buy on Company, target price at Rs 640/Sh (Positive)

NB on Data Patterns: Maintain Buy on Company, target price at Rs 2997/Sh (Positive)

Jefferies on Max Fin: Maintain Buy on Company, target price at Rs 1680/Sh (Positive)

Goldman Sachs on Consumer Durables for FY26: Expect real estate driven demand for electricals and durables to accelerate roved (Positive)

HSBC on Financials: Expect easier liquidity conditions in 2025, which should aid deposit growth. Axis Bank, HDFC Bank, Shriram Fin, Bajaj Fin and ICICI Bank are top picks (Positive)

Systematix on markets: Markets sentiment lack conviction; sector rotation being seen. HDFC Bank, Muthoot, Berger, Marico, Hindalco, Gulfoil, Gail, Sun Ph, Nalco are top picks (Positive)

Emkay on Insurance stocks: Maintain Buy on HDFC Life, Maintain Add on ICICI Pru, SBI Life and LIC (Positive)

Morgan Stanley on Energy: Integrated margin for OMCs was largely stable despite depreciating ` as Brent remained weaker. HPCL and BPCL top picks (Positive)

Nomura on Cement: Maintains a Buy call on UltraTech and Shree Cement while maintaining a neutral call on Nuvoco and ACC (Neutral)

Jefferies on PI Ind: Maintain Buy on Company, cut target price at Rs 4865/Sh (Neutral)

GS on Symphony: Maintain Neutral on Company, target price at Rs 1480/Sh (Neutral)

JP Morgan on Persistent: Maintain Overweight on Company, target price at Rs 6100/Sh (Neutral)

CLSA on Tata Power: Maintain Underperform on Company, target price at Rs 351/Sh (Neutral)

Incred on Persistent: Maintain Hold on Company, target price at Rs 6863/Sh (Neutral)

Citi on HCL Tech: Maintain Neutral on Company, target price at Rs 1815/Sh (Neutral)

Citi on TCS: Maintain Sell on Company, target price at Rs 3935/Sh (Negative)

Citi on LTIM: Maintain Sell on Company, target price at Rs 5710/Sh (Negative)

Citi on Tech M: Maintain Sell on Company, target price at Rs 1475/Sh (Negative)

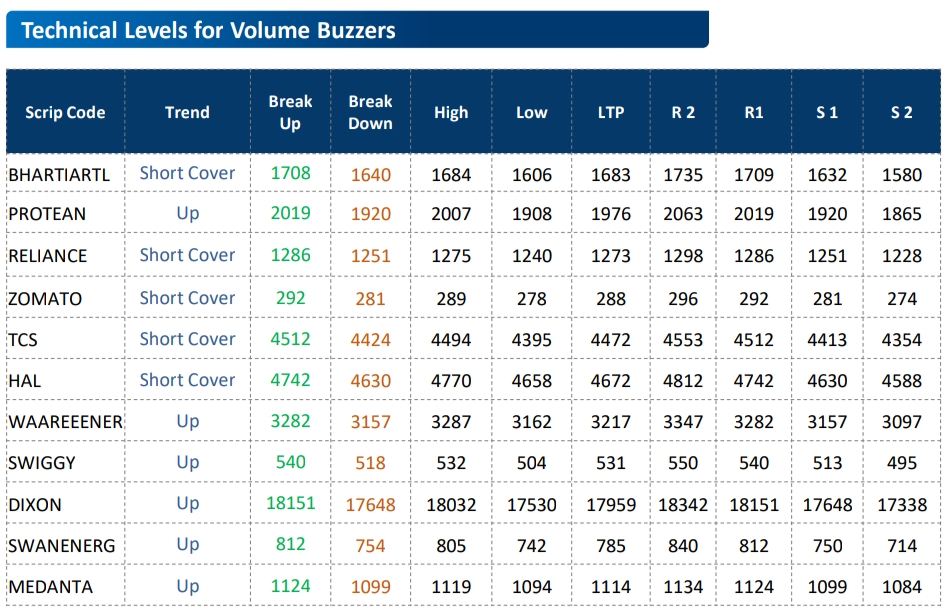

Zoomed into item.

(Disclaimer: The information provided here is investment advice only. Investing in the markets is subject to risks and please consult your advisor before investing.)

(સ્પષ્ટતા: અત્રેથી આપવામાં આવતી તમામ પ્રકારની માહિતી કોઇપણ પ્રકારે રોકાણ/ ટ્રેડીંગ માટેની સલાહ નથી. બજારોમાં રોકાણ જોખમોને આધીન છે અને રોકાણ કરતા પહેલા કૃપા કરીને તમારા સલાહકારની સલાહ લો.)