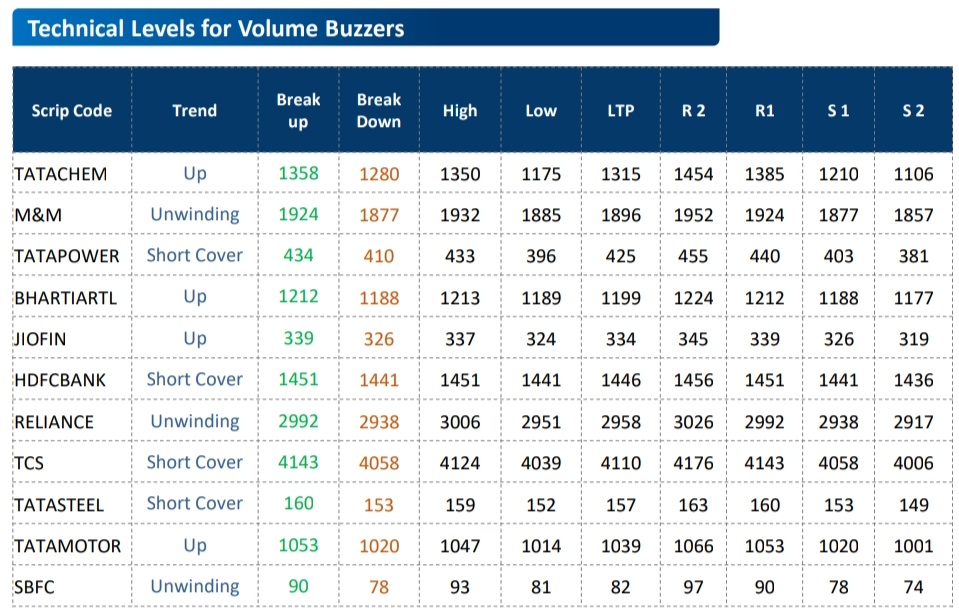

Fund Houses Recommendations: tatachem, tatapower, jiofin, hdfcbank, reliance, tatasteel

અમદાવાદ, 11 માર્ચઃ અગ્રણી બ્રોકરેજ હાઉસ અને ફંડ હાઉસ દ્વારા પસંદગીના શેર્સમાં ખરીદી/ વેચાણ/ હોલ્ડ માટે કરાયેલી ભલામણો અત્રે રોકાણકારોના અભ્યાસ માટે રજૂ કરીએ છીએ.

HSBC on M&M: Maintain Buy on Company, raise target price at Rs 2300 (Positive)

CLSA on Maruti: Maintain Outperform on Company, raise target price at Rs 12890 (Positive)

Citi on ONGC: Maintain Buy on Company, target price at Rs 305 (Positive)

Citi on BPCL: Maintain Buy on Company, target price at Rs 715 (Positive)

Citi on GAIL: Maintain Buy on Company, target price at Rs 200 (Positive)

MOSL on GAIL: Maintain Buy on Company, target price at Rs 215 (Positive)

MOSL on JK Lakshmi: Maintain Buy on Company, target price at Rs 1030 (Positive)

Emkay on Ethos: Maintain Buy on Company, target price at Rs 2850 (Positive)

MS on Zomato: Maintain Overweight on Company, target price at Rs 180 (Positive)

MS on Voltas: Upgrade to Equal weight on Company, target price at Rs 1160 (Positive)

MS on Insurance stocks: HDFC Life, ICICI Pru Life & SBI Life, and Grew Faster Than The 20% RWRP Growth of Private Sector (Positive)

Bernstein on SBIN: Downgrade to Market perform on Bank, target price at Rs 780 (Neutral)

Citi on HPCL: Maintain Buy on Company, target price at Rs 605 (Neutral)

Jefferies on LTIMindtree: Maintain Buy on Company, cut target price at Rs 5890 (Neutral)

Jefferies on GAIL: Maintain Underperform on Company, target price at Rs 150 (Neutral)

CLSA on GAIL: Maintain Sell on Company, target price at Rs 165 (Neutral)

CLSA on HDFC Bank: Downgrade to outperform on Bank, cut target price at Rs 1650 (Negative)

(Disclaimer: The information provided here is investment advice only. Investing in the markets is subject to risks and please consult your advisor before investing.)

(સ્પષ્ટતા: અત્રેથી આપવામાં આવતી તમામ પ્રકારની માહિતી કોઇપણ પ્રકારે રોકાણ, ટ્રેડીંગ માટેની સલાહ નથી. બજારોમાં રોકાણ જોખમોને આધીન છે અને રોકાણ કરતા પહેલા કૃપા કરીને તમારા સલાહકારની સલાહ લો.)