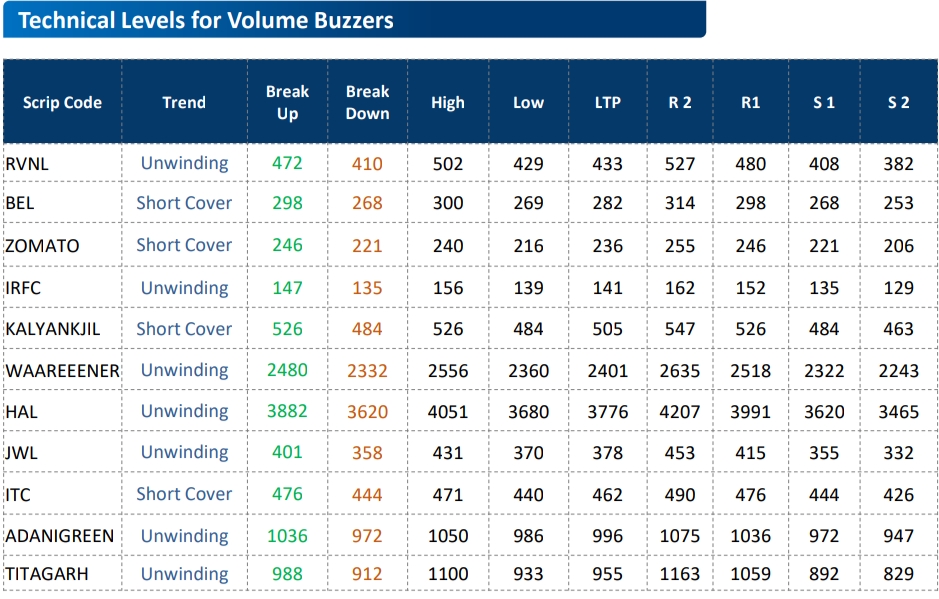

BROKERS CHOICE: ADANIGREEN, UPL, ITC, TVS, HEROMOTO, ONGC, RVNL, BEL, ZOMATO, IRFC, HAL, JWL

AHMEDABAD, 3 FEBRUARY: અગ્રણી બ્રોકરેજ હાઉસ તથા ફંડ હાઉસ તરફથી પસંદગીના સ્ટોક્સમાં ખરીદી\ વેચાણ\ હોલ્ડ કરવા માટે ભલામણ કરવામાં આવી છે. તે રોકાણકારોના અભ્યાસ માટે અત્રે રજૂ કરીએ છીએ.

Investec on UPL: Upgrade to Buy on company, raise target price at Rs 700 (Positive)

Jefferies on ITC: Maintain Buy on Company, target price at Rs 550 (Positive)

MS on ITC: Maintain Overweight on Company, target price at Rs 554 (Positive)

Nomura on Fivestar FIn: Maintain Buy on Company, target price at Rs 870 (Positive)

Kotak Institutional on Market Strategy: FY26 Budget positive for bonds & consumption (Positive)

Goldman Sachs on Auto: Budget favors 2W & affordable cars, EMI savings to benefit TVS, Hero, Bajaj, Maruti, and Ashok Leyland (Positive)

GS on Union Budget: 2-w stocks major beneficiaries, TVS top pick followed by Hero, Eicher and Bajaj Auto (Positive)

MOSL on Union Budget: Tax rates changes are positive, Maruti and Indigo preferred picks. (Positive)

Investec on India Consumer Goods: Urban demand to benefit, Buy GCPL, Marico, ITC, Nykaa, Titan, Sapphire Foods set to gain (Positive)

Jefferies on Auto Sales: January auto wholesales up 9% YoY for tractors, modest 3-4% growth for 2W, PV, and trucks, TVS Motors and Eicher Motors remain top buys. (Positive)

HSBC on Union Budget: Govt balances fiscal consolidation with growth, tax revenues may disappoint slightly but overall assumptions reasonable. (Neutral)

CLSA on Market Strategy: Consumption focus returns, tax cuts could save ₹1.1L/year, large PSU divestments add pressure on share sales. (Neutral)

CLSA on Telecom: FY26 telecom receipts expected to fall 33%, lower BSNL spectrum-related non-cash receipts impact sector. (Neutral)

JP Morgan on Indusind Bank: Maintain Neutral on Bank, cut target price at Rs 1100 (Neutral)

JP Morgan on ONGC: Maintain Neutral on Company, target price at Rs 293 (Neutral)

Jefferies on GMR Airports: Maintain Equal weight on Company, cut target price at Rs 92 (Neutral)

JP Morgan on Union Budget: Budget prioritizes conservatism, tax cuts to boost urban consumption but pressure expenditure, total cost at 0.3% of GDP. (Neutral)

BOFA on Union Budget: Fiscal policy follows a “do no harm” approach, stable revenue assumptions but tax cuts may require reduced exemptions. (Neutral)

Investec on Building Materials: No direct demand push, execution key for FY26, prefer Astral, Kajaria, Century Ply, Greenply, Ambuja, Ultratech. (Neutral)

Goldman Sachs on Insurance: Budget impact small positive, ULIP taxation clarified, high new tax regime adoption, demand trends healthy. (Neutral)

Bernstein on Insurance: ULIP taxation concerns overdone, SBI Life less impacted, Max Financial reverse merger may benefit. (Neutral)

CLSA on India Property: Budget impact marginally positive, tax benefits for second homes, SWAMIH-2 to support stalled housing projects. (Neutral)

Incred on Market Strategy: Cautious stance, favor large caps like Britannia, Hero MotoCorp, and Maruti Suzuki, maintain Nifty target at 23,260. (Neutral)

Bernstein on Market Strategy: Remain underweight on industrials, shift discretionary (ex-auto) to Equal Weight, modest Overweight on durables. (Neutral)

JP Morgan on Infra: FY26 infra capex growth underwhelming, defense capex picks up, muted outlook for L&T. (Neutral)

Capital Economics on Tariffs: Tariffs could push Canada and Mexico into recession, US inflation may rise above 3%, interest rate cuts unlikely (Negative)

Nomura on Tariffs: No deal likely before Feb 4, tit-for-tat escalation expected, rising tariff risks for Europe, markets brace for slower growth & higher inflation. (Negative)

MOSL on Capital Goods: Cap Goods will face challenges in growth, downgrade Hitachi & Thermax to sell (Negative)

Jefferies on OMCs: Govt’s budgeted LPG subsidy implies that OMCs will bear 69% of FY25 under-recoveries, budgeted LPG subsidy move suggests govt has capped marketing profitability of OMCs (Negative)

(Disclaimer: The information provided here is investment advice only. Investing in the markets is subject to risks and please consult your advisor before investing.)

(સ્પષ્ટતા: અત્રેથી આપવામાં આવતી તમામ પ્રકારની માહિતી કોઇપણ પ્રકારે રોકાણ/ ટ્રેડીંગ માટેની સલાહ નથી. બજારોમાં રોકાણ જોખમોને આધીન છે અને રોકાણ કરતા પહેલા કૃપા કરીને તમારા સલાહકારની સલાહ લો.)