Stocks in News: EIDPARRY, EIH, TBZ, RBZJEWELL, NBCC, EPL, GICHOUSING, BHEL, BEML

AHMEDABAD, 12 FEBRUARY:

EID Parry: Net profit at Rs. 415 cr vs Rs 216 cr, Revenue at Rs. 8720 cr vs Rs 7770 cr (YoY) (Positive)

Techno Engineering: Net profit at Rs 106 cr vs Rs 77.6 cr, Revenue at Rs. 676 cr vs Rs 365 cr (YoY) (Positive)

Raj Rayons: Net profit at Rs. 8.2 cr vs Rs 2.0 cr, Revenue at Rs. 230 cr vs Rs 195 cr (YoY) (Positive)

SRM Contractors: Net profit at Rs 21.3 cr vs Rs 5.2 cr, Revenue at Rs. 150 cr vs Rs 87 cr (YoY) (Positive)

Jaypee Infra: Net profit at Rs. 1365 cr vs Rs 92 cr (Exceptional profit Rs 514 cr), Revenue at Rs. 1317 cr vs Rs 218 cr (YoY) (Positive)

Ramky Infra: Net profit at Rs. 59.8 cr vs Rs 37.6 cr, Revenue at Rs. 459 cr vs Rs 440cr (YoY) (Positive)

EIH: Net profit at Rs. 278.0 cr vs Rs 230.0 cr, Revenue at Rs. 800 cr vs Rs 741 cr (YoY) (Positive)

Shree Pushkar: Net profit at Rs. 15.9 cr vs Rs 7.6 cr, Revenue at Rs. 217 cr vs Rs 175 cr (YoY) (Positive)

Indo Amines: Net profit at Rs. 11.3 cr vs Rs 9.8 cr, Revenue at Rs 259 cr vs Rs 194 cr (YoY) (Positive)

TBZ: Net profit at Rs. 29.9 cr vs Rs 21.8 cr, Revenue at Rs 927 cr vs Rs 740 cr (YoY) (Positive)

RBZ Jewellers: Net profit at Rs. 13 cr vs Rs 6.7 cr, Revenue at Rs 194 cr vs Rs 116 cr (YoY) (Positive)

Alufloride: Net profit at Rs. 6 cr vs Rs 3.7 cr, Revenue at Rs 47.5 cr vs Rs 37.3 cr (YoY) (Positive)

Ceinsys Tech: Net profit at Rs. 17.8 cr vs Rs 10.4 cr, Revenue at Rs 112 cr vs Rs 62.6 cr (YoY) (Positive)

NBCC: Net profit at Rs. 138 cr vs Rs 111 cr, Revenue at Rs 2827 cr vs Rs 2424 cr (YoY) (Positive)

EPL: Net profit at Rs. 94.0 cr vs Rs 86.0 cr, Revenue at Rs 1000 cr vs Rs 975 cr (YoY) (Positive)

Ashapuri Gold: Net profit at Rs. 4.2 cr vs Rs 2.0 cr, Revenue at Rs 101 cr vs Rs 50 cr (YoY) (Positive)

Kolte Patil: Net profit at Rs. 25 cr vs loss Rs 63 cr, Revenue at Rs 349.7 cr vs Rs 75.8 cr (YoY) (Positive)

GIC Housing: Net profit at Rs. 49.7 cr vs Rs 35.7 cr, Revenue at Rs 265 cr vs Rs 258 cr (YoY) (Positive)

Taal Enterprises: Net profit at Rs. 11.4 cr vs Rs 7.7 cr, Revenue at Rs 1225 cr vs Rs 1118 cr (YoY) (Positive)

Bajaj Health: Net profit at Rs. 14.9 cr vs Rs 5.5 cr, Revenue at Rs 123 cr vs Rs 108 cr (YoY) (Positive)

HG Infra: Jointly with DEC Infrastructure bags letter of acceptance from Rail Land Development Authority (RLDA), New Delhi for EPC project worth ₹2,195.68 crore (Positive)

BHEL: Company gets LoI for a project worth ₹6,200 crore from Damodar Valley Corporation (Positive)

BEML: Company enters into strategic partnership with STX Engine Forge for advanced defence & marine engine solutions (Positive)

Cyient DLM: Company announced a production contract with Boeing Global Services (BGS) for precision-machined parts and assemblies. (Positive)

Coromandel: Government of Andhra Pradesh Extends Subsidies for Rs 15.39 Billion Investment, Andhra Pradesh Extends 45% Incentive on Fixed Capital Investment (Positive)

Ramco Systems: Payroll solution provider said Papua New Guinea’s national carrier, Air Niugini, has chosen its Payce platform to modernise its payroll operations (Positive)

Bharat Electronics: Safran and Company Forge a Partnership in the Defense Sector, Safran – Signing of a Partnership to Create A Joint Venture (Positive)

Happy Forgings: Company Signs MOU for Long-term Supply of Heavy, Forged and Precision Machined Industrial Components (Positive)

Jupiter Wagons: Company gets LoA for order value of Rs 600 cr (Positive)

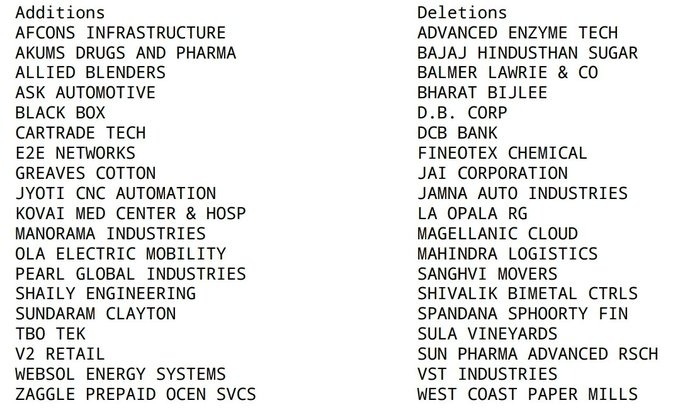

Addition & Deletion in MSCI Smallcap Index

IRCTC: Net profit at Rs. 341 cr vs poll of Rs 352 cr, Revenue at Rs 1225 cr vs poll of Rs 1209 cr (Neutral)

Birla Soft: Net profit at Rs. 117 cr vs poll of Rs 121 cr, Revenue at Rs 1363 cr vs poll of Rs 1381 cr (Neutral)

Kopran: Net profit at Rs. 10.3 cr vs Rs 15.4 cr, Revenue at Rs 166 cr vs Rs 158 cr (YoY) (Neutral)

Ritco Logistics: Net profit at Rs. 10.2 cr vs Rs 8.7 cr, Revenue at Rs 313 cr vs Rs 240 cr (YoY) (Neutral)

Kirloskar oil: Net profit at Rs. 71.3 cr vs Rs 89.8 cr, Revenue at Rs 1453.7 cr vs Rs 1391.3 cr (YoY) (Neutral)

N.R. Agarwal: Net profit at Rs. 12.7 cr vs Rs 31.4 cr, Revenue at Rs 420 cr vs Rs 330 cr (YoY) (Neutral)

HEG: Net profit at Rs. 83.4 cr vs Rs 43.7 cr, Revenue at Rs 478.4 cr vs Rs 562.4 cr (YoY) (Neutral)

Gujarat Alkalis: Net loss at Rs. 11.2 cr vs Rs 115.0 cr, Revenue at Rs 1029 cr vs Rs 920 cr (YoY) (Neutral)

Berger Paints: Net profit at Rs. 295 cr vs poll of Rs 289 cr, Revenue at Rs 2975 cr vs poll of Rs 2939 cr (Neutral)

SAIL: Net Profit Down 66.5% at ₹141.9 Cr Vs ₹422.9 Cr (YoY) Estimate Rs 38 cr loss. Revenue Up 4.9% at ₹24,489.9 Cr Vs ₹23,348.6 Cr (YoY) Estimate Rs 23348 cr (Neutral)

Vodafone Idea: Net loss at Rs 6607 Cr Vs poll Rs 6979 Cr, Revenue at Rs 11117 Cr Vs poll Rs 11254 Cr (Neutral)

Mamata: Net profit at Rs. 8.7 cr vs Rs 8.3 cr, Revenue at Rs 73 cr vs Rs 51 cr (YoY) (Neutral)

HBL: Net profit at Rs. 64 cr vs Rs 79 cr, Revenue at Rs 450 cr vs Rs 599 cr (YoY) (Neutral)

Wimplast: Net profit at Rs. 13.5 cr vs Rs 12.8 cr, Revenue at Rs 93 cr vs Rs 87 cr (YoY) (Neutral)

Cosmo First: Net profit at Rs. 29.6 cr vs Rs 11.4 cr, Revenue at Rs. 700 cr vs Rs 624 cr (YoY) (Neutral)

MOIL: Net profit at Rs. 63.7 cr vs Rs 54.1 cr, Revenue at Rs. 367 cr vs Rs 306 cr (YoY) (Neutral)

Ahlucont: Net profit at Rs. 49.4 cr vs Rs 70.6 cr, Revenue at Rs. 951 cr vs Rs 1026 cr (YoY). (Neutral)

Maithan Alloys: Net profit at Rs. 90 cr vs Rs 85 cr, Revenue at Rs. 531 cr vs Rs 448 cr (YoY). (Neutral)

Waterbase: Net loss at Rs. 3.9 cr vs Rs 4.2 cr, Revenue at Rs. 66 cr vs Rs 74 cr (YoY). (Neutral)

Salzer: Net Profit at Rs 15.5 Cr Vs Rs 13.5 Cr, Revenue at Rs 341 Cr Vs Rs 270 Cr (YoY) (Neutral)

Medicamen: Net Profit at Rs 3.8 Cr Vs Rs 3.3 Cr, Revenue at Rs 45 Cr Vs Rs 46 Cr (YoY) (Neutral)

Zomato: Company now allows users to customize the platform fee, ranging from Rs 10 to Rs 40. (Neutral)

Vedanta: Committee of directors approves raising up to Rs 3,000 crore via NCDs (Neutral)

TVS Motor: Company signs accord with Karnataka to invest Rs 2,000 cr in 5 yrs. (Neutral)

Maruti: The company has set April 1, 2025, as the appointed date for its merger with Suzuki Motor Gujarat (SMG). (Neutral)

Bayer Crop: Net Profit at Rs 34 Cr Vs Rs 93 Cr, Revenue at Rs 105 Cr Vs Rs 95 Cr (YoY) (Negative)

TV Today: Net Profit at Rs 8.7 Cr Vs Rs 29 Cr, Revenue at Rs 236 Cr Vs Rs 262 Cr (YoY) (Negative)

Gopal: Net Profit at Rs 5.3 Cr Vs Rs 17.9 Cr, Revenue at Rs 393 Cr Vs Rs 368 Cr (YoY) (Negative)

IRCON: Net Profit at Rs 140 Cr Vs Rs 185 Cr, Revenue at Rs 2570 Cr Vs Rs 2875 Cr (YoY) (Negative)

(Disclaimer: The information provided here is investment advice only. Investing in the markets is subject to risks and please consult your advisor before investing.)

(સ્પષ્ટતા: અત્રેથી આપવામાં આવતી તમામ પ્રકારની માહિતી કોઇપણ પ્રકારે રોકાણ/ ટ્રેડીંગ માટેની સલાહ નથી. બજારોમાં રોકાણ જોખમોને આધીન છે અને રોકાણ કરતા પહેલા કૃપા કરીને તમારા સલાહકારની સલાહ લો.)