BROKERS CHOICE: ANANTRAJ, SAGILITY, ONGC, INFY, WIPRO, IOC, BPCL, HPCL, SRF, OLAELE, RIL, IREDA

AHMEDABAD, 20 DECEMBER: અગ્રણી બ્રોકરેજ હાઉસ તથા ફંડ હાઉસ તરફથી પસંદગીના સ્ટોક્સમાં ખરીદી\ વેચાણ\ હોલ્ડ કરવા માટે ભલામણ કરવામાં આવી છે. તે રોકાણકારોના અભ્યાસ માટે અત્રે રજૂ કરીએ છીએ.

MOSL on *Anant Raj:* Initiate Buy on Company, target price at Rs 1100/Sh (Positive)

Jefferies on *Sagility:* Initiate Buy on Company, target price at Rs 52/Sh (Positive)

CLSA says incremental oil demand for 2025 may match non-OPEC production growth. OMCs’ margins suggest a strong Q3 for *IOC, BPCL, and HPCL*. Continues to prefer *ONGC* (Positive)

Nomura on *Indian IT:* Expects revenue growth for covered large-caps in Indian IT sector to improve in FY26. (Positive)

Jefferies on *Indian IT:* Accenture’s strong Q1 revenue and net hiring are positive. Our top picks are: Positive signals for *Coforge, TCS, Wipro, and LTIMindtree* (Positive)

Nuvama on *Indian IT:* Continued to remain positive on IT sector, argument to upgrade Indian IT sector (Positive)

Citi on *Indian IT:* Accenture’s guidance assumes bottom of deterioration of discretionary spending. Our top picks are: *Infosys and HCL Tech* (Positive)

CLSA on *Auto Sector:* E-2W sales picking up after subsidy cuts, led by affordable model launches (Positive)

Jefferies on *Auto Sector:* EV penetration in 2Ws has stagnated in 4-7% range for last two years (Neutral)

Nuvama on *SRF:* Maintain Buy on Company, target price at Rs 2628/Sh (Neutral)

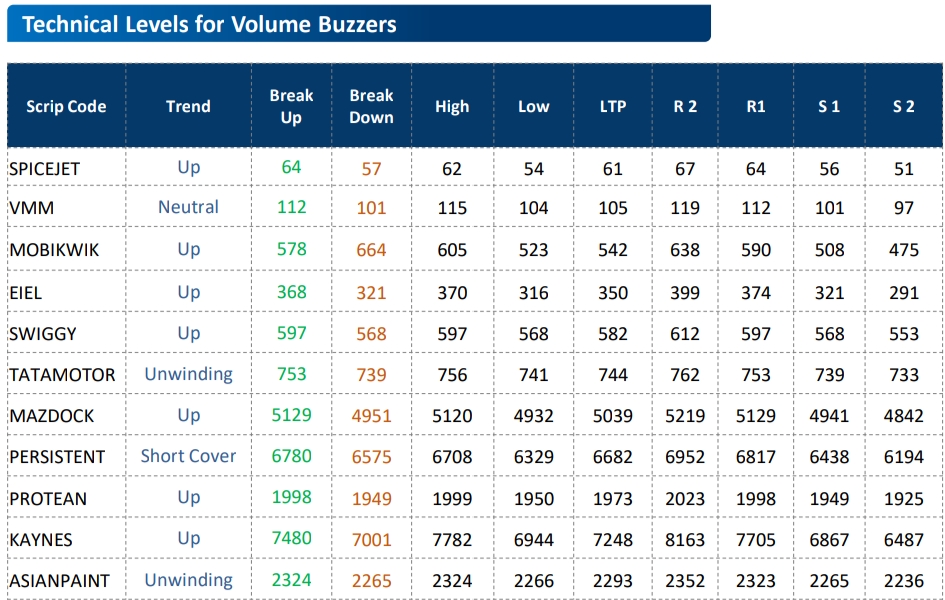

Zoomed into item.

(Disclaimer: The information provided here is investment advice only. Investing in the markets is subject to risks and please consult your advisor before investing.)

(સ્પષ્ટતા: અત્રેથી આપવામાં આવતી તમામ પ્રકારની માહિતી કોઇપણ પ્રકારે રોકાણ/ ટ્રેડીંગ માટેની સલાહ નથી. બજારોમાં રોકાણ જોખમોને આધીન છે અને રોકાણ કરતા પહેલા કૃપા કરીને તમારા સલાહકારની સલાહ લો.)