BROKERS CHOICE: AMBUJACEMENT, RIL, ULTRATECH, SUZLON, LARSEN, BANDHANBANK, INFOSYS, WIPRO, JIOFINANCE

AHMEDABAD, 25 MARCH: અગ્રણી બ્રોકરેજ હાઉસ તથા ફંડ હાઉસ તરફથી પસંદગીના સ્ટોક્સમાં ખરીદી\ વેચાણ\ હોલ્ડ કરવા માટે ભલામણ કરવામાં આવી છે. તે રોકાણકારોના અભ્યાસ માટે અત્રે રજૂ કરીએ છીએ.

UBS on Ambuja Cement: Upgrade to Buy on Company, raise target price at Rs 620 (Positive)

UBS on Ultratech: Upgrade to Buy on Company, raise target price at Rs 13000 (Positive)

UBS on Dalmia Bharat: Upgrade to Buy on Company, target price at Rs 2100 (Positive)

MOSL on Suzlon: Maintain Buy on Company, target price at Rs 70 (Positive)

GS on Larsen: Maintain Buy on Company, target price at Rs 3640 (Positive)

CLSA on Bandhan Bank: Maintain Outperform on Bank, target price at Rs 220 (Positive)

MOSL on India Strategy: Consumption likely to get better Selective stock picking opportunities have emerged. Key picks Devyani International, LT Food,Page Industries, Devyani, Metro Brands, V-Mart, Lemontree Hotels and Cello World (Positive)

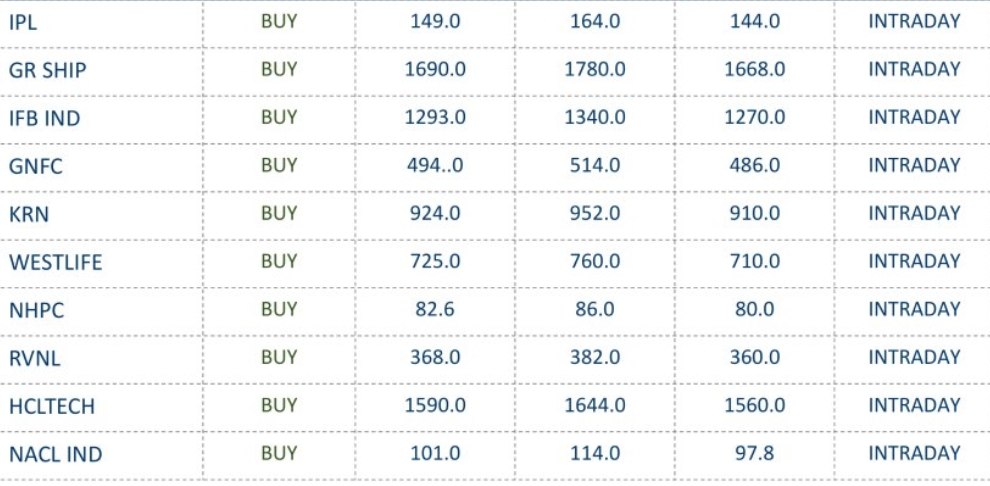

Macquarie on Food delivery vs Franchises: Prefer restaurants space as higher discretionary incomes should drive a recovery. Prefer Devyani & Westlife (Positive)

Macquarie on Food delivery vs Franchises: Cautious On Zomato and Swiggy (Neutral)

Bernstein on India Strategy: Impact of reciprocal tariffs is more on the US than on India (Neutral)

UBS on ACC: Maintain Buy on Company, cut target price at 2250 (Neutral)

Jefferies on Infosys: Maintain Buy on Company, cut target price at 1835 (Neutral)

(Disclaimer: The information provided here is investment advice only. Investing in the markets is subject to risks and please consult your advisor before investing.)

(સ્પષ્ટતા: અત્રેથી આપવામાં આવતી તમામ પ્રકારની માહિતી કોઇપણ પ્રકારે રોકાણ/ ટ્રેડીંગ માટેની સલાહ નથી. બજારોમાં રોકાણ જોખમોને આધીન છે અને રોકાણ કરતા પહેલા કૃપા કરીને તમારા સલાહકારની સલાહ લો.)