HDB FINANCIAL SERVICES: Granular Strategy, Scalable Execution (MOSL)

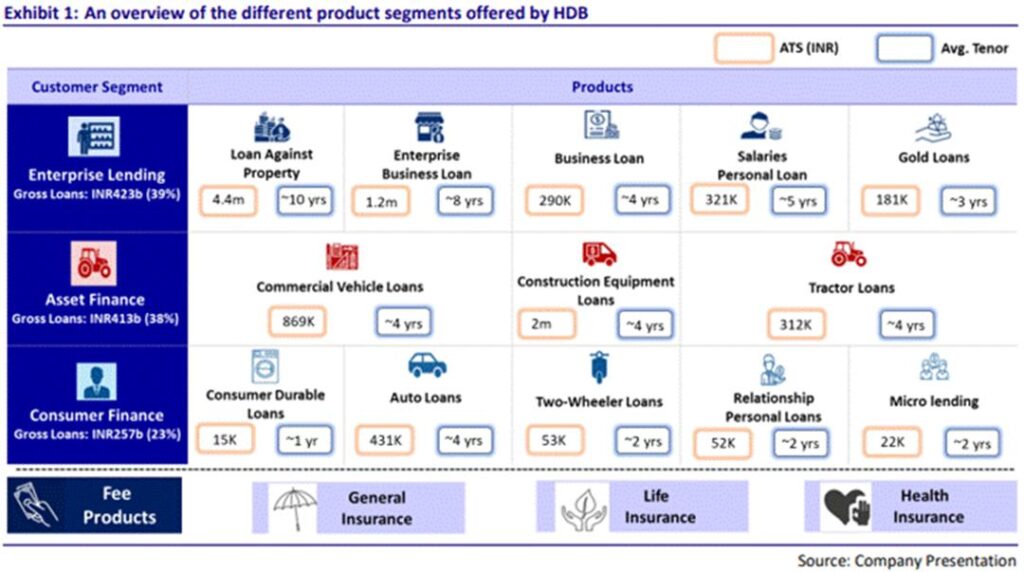

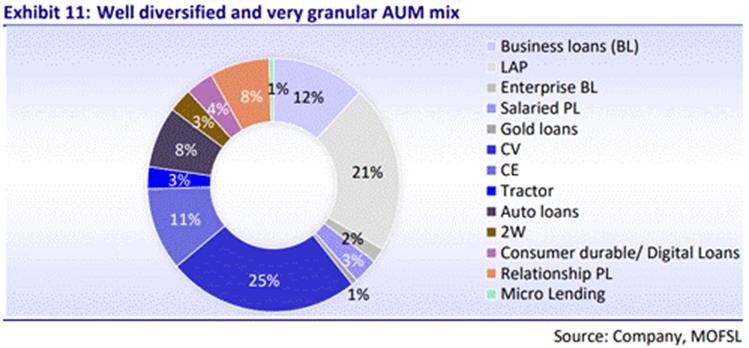

Ahmedabad,21st August: HDB Financial Services (HDB) is the seventh-largest diversified, retail-focused NBFC in India with an AUM of ~INR1.1t as of Jun’25. The company delivered a ~20% AUM CAGR over FY22-FY25 and has a wide nationwide footprint, operating more than 1,770 branches across 31 Indian States.

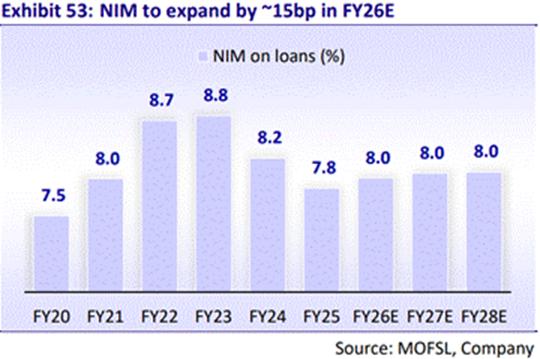

HDB is well positioned to benefit from a declining interest rate cycle, with ~77% of its loan book on fixed rates, while ~33% of its borrowings on floating rates will benefit from the decline in the policy repo rate. Coupled with its AAA credit rating, the company is already experiencing benefits on its incremental cost of funds (CoF), which will pave the way for a NIM expansion in FY26.

HDB has built one of India’s most granular and credit-disciplined lending franchises, rooted in a bottom-up approach that combines product breadth, geographic depth, and robust risk management. With a strategic focus on underserved segments across Tier 2 and beyond, a direct sourcing-led origination engine, and execution precision honed over multiple credit cycles, HDB is now entering a phase of scalable, profitable growth. Backed by HDFC Bank’s institutional ethos and a seasoned management team, the company is positioned to deliver 19% AUM CAGR (over FY25-28E) with expanding RoAs (from 2.2% in FY25 to 2.6% by FY28) — without compromising on asset quality or governance.

With the benefits of scale now beginning to kick in, we project HDB to deliver a PAT CAGR of ~26% over FY25-FY28 and an RoA/RoE of 2.6%/16.5% by FY28, supported by a gradual decline in credit costs and higher operating leverage. We initiate coverage on HDB with a Neutral rating and a TP of INR860 (premised on 2.7x Sep’27E P/BV). With valuations largely factoring in medium-term growth potential, we would look for clearer evidence of stronger execution on loan growth, ability to better navigate industry/product cycles, and structural (not just cyclical) improvement in its return ratios.

Granular origination at scale

HDB employs a diversified omni-channel sourcing model. Direct sourcing contributed ~82% of its FY25 disbursements. This phygital (physical + digital) approach integrates in-house distribution teams, external partners, and strong digital capabilities to efficiently target customers. Over 70% of HDB’s branches are located in tier-4 and even smaller towns, enabling a strong rural presence across ‘Bharat’ and reaching underbanked and unbanked segments. This is complemented by a strong in-house tele-calling team, which serves as the primary distribution channel for products like personal loans and consumer durables, leveraging analytics to identify eligible borrowers.

NIM tailwinds in a softening rate cycle

HDB’s yield profile remains well-supported by its diversified product mix, with higher-yielding segments such as unsecured enterprise loans and select retail products balancing the lower-yield secured portfolio. On the asset side, ~77% of the loan book is on fixed rates, which will prevent any downward pressure on the back-book yields. Continued focus on direct origination and operations in underserved markets will enable better pricing power, sustaining

About 33% of HDB’s liabilities are on floating rates, within which ~90-95% of its bank borrowings are linked to EBLR and have been repriced already in line with market/external benchmarks. We expect HDB to expand its NIM to 8.0% over FY26–28E (compared to ~7.8% in FY25).

Operating efficiencies to drive improvement in cost ratios

HDB’s scale benefits, digital origination, and centralized processing are expected to deliver sustained operating leverage over the medium term. The cost-to-income ratio, which stood at ~43% in FY25, is projected to improve by ~330bp to ~40%, and opex/avg. assets would improve ~20bp, reaching 3.5% by FY28. This will be driven by productivity gains, process automation, and better operating spread across an expanding branch network. These efficiency gains will provide a structural boost to profitability.

Near-term headwinds, but asset quality anchored to prudent underwriting

HDB has built a risk-calibrated and diversified loan portfolio, balancing growth with prudent underwriting. While the company primarily serves the low- and middle-income segments, which inherently carry higher risk, it has maintained a conservative approach in customer selection. As of FY25, NTC customers constituted only ~12% of the overall customer base, with the majority being customers with a credit track record, helping to anchor portfolio quality. ~73% of the portfolio comprises secured loans backed by underlying collateral.

We expect headline GS3 to remain broadly range-bound at the current levels of 2.5-2.6% over FY26-FY27, with credit costs gradually moderating to ~1.9% by FY28E from 2.2% in FY25.

Expect ~19% AUM CAGR to translate into a PAT CAGR of 26% over FY25-28

HDB delivered an AUM and PAT CAGR of 20% and 29%, respectively, over FY22-FY25. However, FY25 was a tough year for HDB, with macro and industry weakness translating into weakness in AUM growth and profitability. HDB will grow faster than system credit, with an expected AUM CAGR of ~19%, a PAT CAGR of ~26% over FY25-FY28, and an RoA/RoE of 2.6%/16.5% in FY28.

Valuation and View: Strong franchise, but positives priced in

HDB offers a play on India’s high-growth, underpenetrated retail lending market. With an AUM of ~INR1.1t and ~20m customers, the company has built a granular, largely secured loan portfolio (~73% secured) and demonstrated credit discipline. With strong governance, in-house collections, and a differentiated sourcing model, HDB has the foundations for sustainable value creation.

(Disclaimer: The information provided here is investment advice only. Investing in the markets is subject to risks and please consult your advisor before investing.)

(સ્પષ્ટતા: અત્રેથી આપવામાં આવતી તમામ પ્રકારની માહિતી કોઇપણ પ્રકારે રોકાણ/ ટ્રેડીંગ માટેની સલાહ નથી. બજારોમાં રોકાણ જોખમોને આધીન છે અને રોકાણ કરતા પહેલા કૃપા કરીને તમારા સલાહકારની સલાહ લો.)