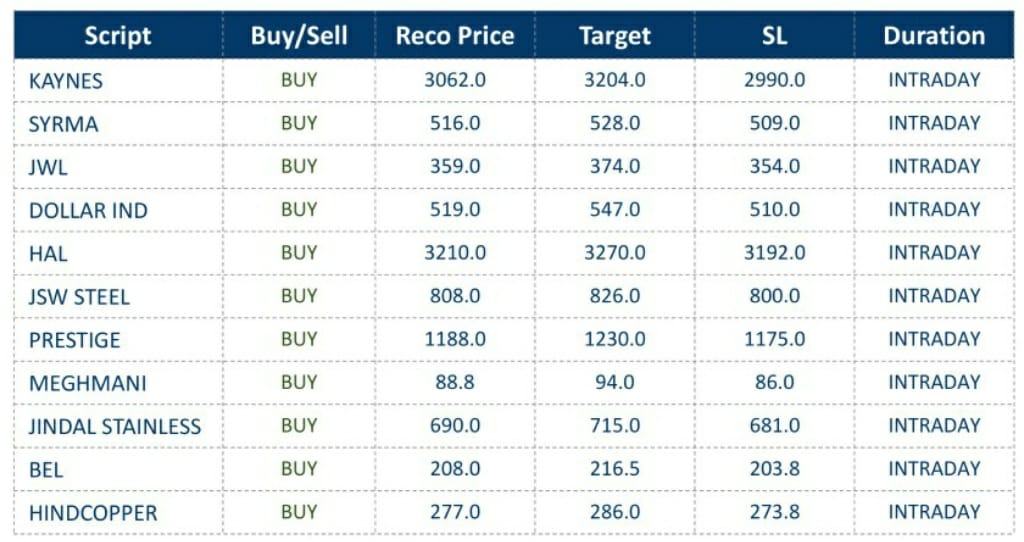

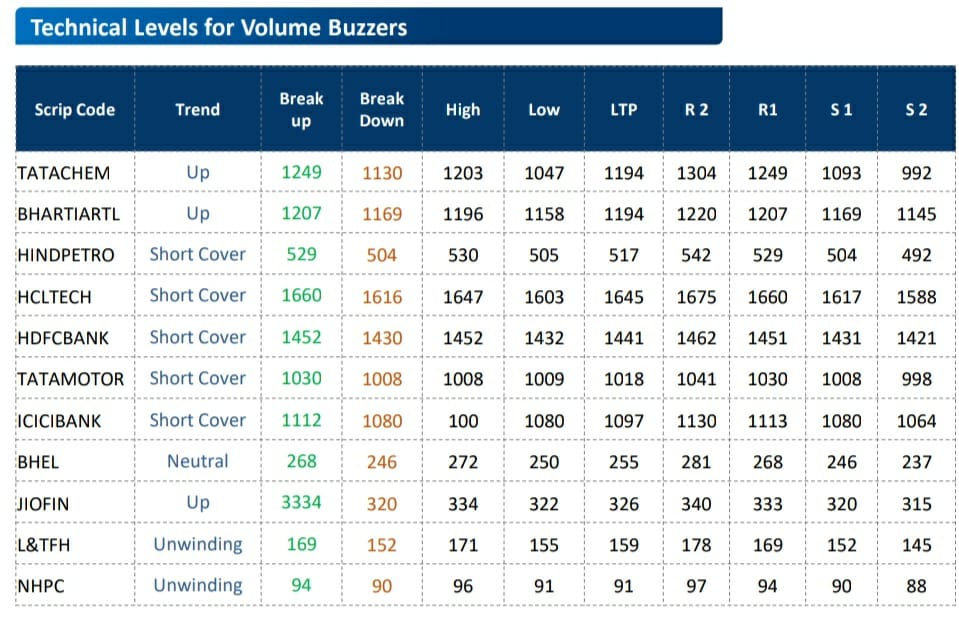

Fund Houses Tips: Tata Chem, JioFin, JSW Steel, Jindal Stainless Steel, BEL, Bharati Airtel

અમદાવાદ, 7 માર્ચઃ વિવિધ ફંડ હાઉસ અને બ્રોકરેજની નજરે શોર્ટ ટર્મ, ઈન્ટ્રા ડે, અને લોંગ ટર્મ વ્યૂહ સાથે ધ્યાનમાં લેવા જેવા શેર્સની યાદી…

JP Morgan

JSW Steel: Maintain Overweight on Company, target price at Rs 980/sh (Positive)

Tata Steel: Maintain Overweight on Company, target price at Rs 170/sh (Positive)

Hindalco: Maintain Overweight on Company, target price at Rs 600/sh (Positive)

Vedanta: Maintain Neutral on Company, target price at Rs 280/sh (Neutral)

SAIL: Maintain Neutral on Company, target price at Rs 120/sh (Neutral)

Coal India: Maintain Neutral on Company, target price at Rs 480/sh (Neutral)

NMDC: Maintain Neutral on Company, target price at Rs 195/sh (Neutral)

UBS

BEL: Maintain Buy on Company, raise target price at Rs 257/sh (Positive)

HSBC

Phoenix Mills: Maintain Buy on Company, raise target price at Rs 3130/sh (Positive)

CLSA

Syrma SGS: Initiate Buy on Company, target price at Rs 645/sh (Positive)

Restaurant Brands: Maintain Buy on Company, target price at Rs 146/sh (Positive)

Jubilant Foods: Maintain Sell on Company, cut target price at Rs 439/sh (Neutral)

Devyani: Maintain Outperform on Company, cut target price at Rs 177/sh (Neutral)

Westlife: Maintain Sell on Company, target price at Rs 752/sh (Neutral)

DAM

Aavas Fin: Upgrade to Buy on Company, target price at Rs 1660/sh (Positive)

Nuvama

MGL: Maintain Buy on Company, target price at Rs 1601/sh (Positive)

Kotak

Muthoot Fin: Maintain Add on Company, target price at Rs 1500/sh (Positive)

Federal Bank: Maintain Buy on Bank, target price at Rs 185/sh (Positive)

Jefferies

Banks: RBI’s specific actions can become generic risks for Lenders (Neutral)

(Disclaimer: The information provided here is investment advice only. Investing in the markets is subject to risks and please consult your advisor before investing.)

(સ્પષ્ટતા: અત્રેથી આપવામાં આવતી તમામ પ્રકારની માહિતી કોઇપણ પ્રકારે રોકાણ, ટ્રેડીંગ માટેની સલાહ નથી. બજારોમાં રોકાણ જોખમોને આધીન છે અને રોકાણ કરતા પહેલા કૃપા કરીને તમારા સલાહકારની સલાહ લો.)