BROKERS CHOICE: INFOSYS, BAJAJFINA, HDFCLIFE, LGELE, EMMVEE, GROWW, UNIONBNK, SHRIRAMFINA, LTTS, MEESHO, CIPLA

AHMEDABAD, 16 JANUARY: અગ્રણી બ્રોકરેજ હાઉસ તથા ફંડ હાઉસ તરફથી પસંદગીના સ્ટોક્સમાં ખરીદી\ વેચાણ\ હોલ્ડ કરવા માટે ભલામણ કરવામાં આવી છે. તે રોકાણકારોના અભ્યાસ માટે અત્રે રજૂ કરીએ છીએ.

MS on Shriram Fin: Maintain Overweight on Company, raise target price at Rs 1325 (Positive)

Jefferies on Infosys: Maintain Buy on Company, raise target price at Rs 1880 versus Rs 1860 (Positive)

DAM on Infosys: Maintain Buy on Company, raise target price at Rs 1870 versus Rs 1650 (Positive)

Antique on Infosys: Maintain Hold on Company, raise target price at Rs 1780 versus Rs 1675 (Positive)

Axis Cap on Infosys: Maintain Add on Company, raise target price at Rs 1780 versus Rs 1630 (Positive)

Emkay on Infosys: Maintain Buy on Company, raise target price at Rs 1750 versus Rs 1650 (Positive)

Systematix on Infosys: Maintain Hold on Company, raise target price at Rs 1743 versus Rs 1649 (Positive)

Investec on Infosys: Maintain Buy on Company, raise target price at Rs 1730 versus Rs 1690 (Positive)

Antique on Infosys: Maintain Buy on Company, raise target price at Rs 1780 versus Rs 1675 (Positive)

BofA on Infosys: Maintain Buy on Company, raise target price at Rs 1840 (Positive)

MS on Infosys: Maintain Equal weight on Company, raise target price at Rs 1760 (Positive)

CLSA on Bajaj Finance: Maintain Outperform on Company, target price at Rs 1200 (Neutral)

Citi on HDFC Life: Maintain Buy on Company, raise target price at Rs 1020 (Neutral)

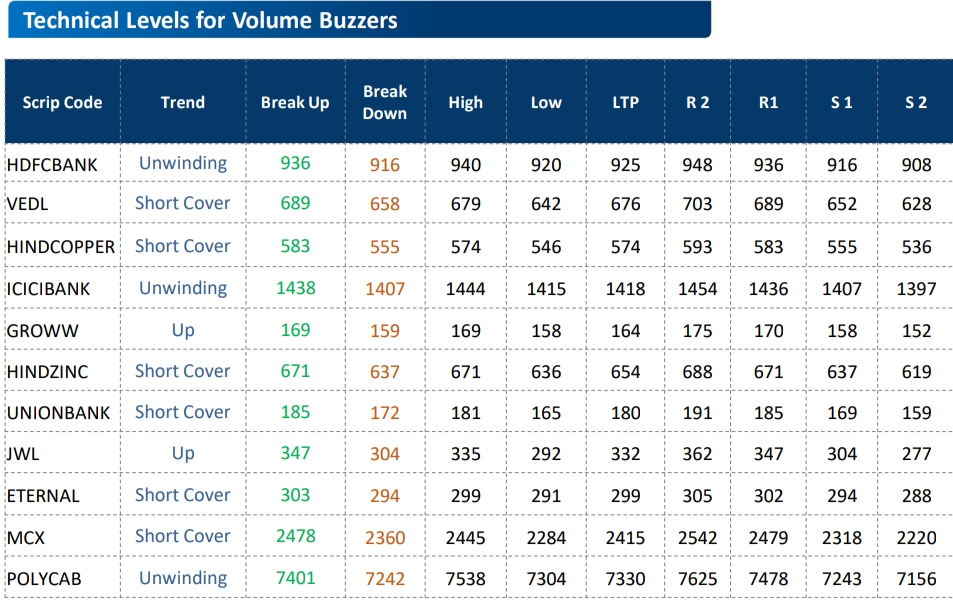

UBS on Union Bank: Maintain Neutral on Company, raise target price at Rs 195 (Positive)

Nomura on United Spirits: Initiate Buy on Company, target price at Rs 1650 (Positive)

JP Morgan on LG India: Maintain Overweight on Company, target price at Rs 1765 (Positive)

Investec on Aditya Vision: Initiate Buy on Company, target price at Rs 675 (Positive)

Investec on Electronics Mart: Initiate Buy on Company, target price at Rs 125 (Positive)

Jefferies on Emmvee: Maintain Buy on Company, target price at Rs 320 (Positive)

Citi on 360 One: Maintain Buy on Company, raise target price at Rs 1700 (Positive)

Jefferies on Groww: Maintain Buy on Company, raise target price at Rs 195 (Positive)

Citi on Groww: Maintain Buy on Company, target price at Rs 195 (Positive)

Citi on OMCs: Govt assurances regarding policy stability and recognition of the need for reasonable returns provide further comfort (Positive)

Nuvama on Chemicals: Expects a gradual and slow recovery, warranting a selective approach. Deepak Nitrite, Himadri Specialty Chemicals, PCBL, Thirumalai Chemicals, and Navin Fluorine have been top performers. (Neutral)

Citi on L&T: Maintain Buy on Company, target price at Rs 4810 (Neutral)

MS on Meesho: Maintain Equal weight on Company, target price at Rs 169 (Neutral)

Macquarie on Infosys: Maintain Neutral on Company, target price at Rs 1560 (Neutral)

Citi on Infosys: Maintain Neutral on Company, raise target price at Rs 1700 (Neutral)

Bernstein on Bajaj Finance: Maintain Underperform on Company, target price at Rs 750 (Neutral)

MS on HDFC Life: Maintain Overweight on Company, target price at Rs 875 (Neutral)

Jefferies on HDFC Life: Maintain Buy on Company, target price at Rs 900 (Neutral)

Investec on Angle One: Maintain Buy on Company, target price at Rs 2850 (Neutral)

MS on LTTS: Maintain Equal weight on Company, target price at Rs 4420 (Neutral)

MS on Cipla: Maintain Underweight on Company, target price at Rs 1292 (Neutral)

Jefferies on 360 One: Maintain Buy on Company, target price at Rs 1410 (Neutral)

Jefferies on HDFC AMC: Maintain Buy on Company, target price at Rs 3120 (Neutral)

Bernstein on HDFC AMC: Maintain Outperform on Company, target price at Rs 3000 (Neutral)

(Disclaimer: The information provided here is investment advice only. Investing in the markets is subject to risks and please consult your advisor before investing.)

(સ્પષ્ટતા: અત્રેથી આપવામાં આવતી તમામ પ્રકારની માહિતી કોઇપણ પ્રકારે રોકાણ/ ટ્રેડીંગ માટેની સલાહ નથી. બજારોમાં રોકાણ જોખમોને આધીન છે અને રોકાણ કરતા પહેલા કૃપા કરીને તમારા સલાહકારની સલાહ લો.)