Fund Houses Recommendations: અદાણી પોર્ટ્સ, ઇન્ડિગો, ટાટા મોટર્સ, દિલ્હીવેરી, રિલાયન્સ ઇન્ડસ્ટ્રીઝ, જિયો ફાઇનાન્સ, ઇરેડા

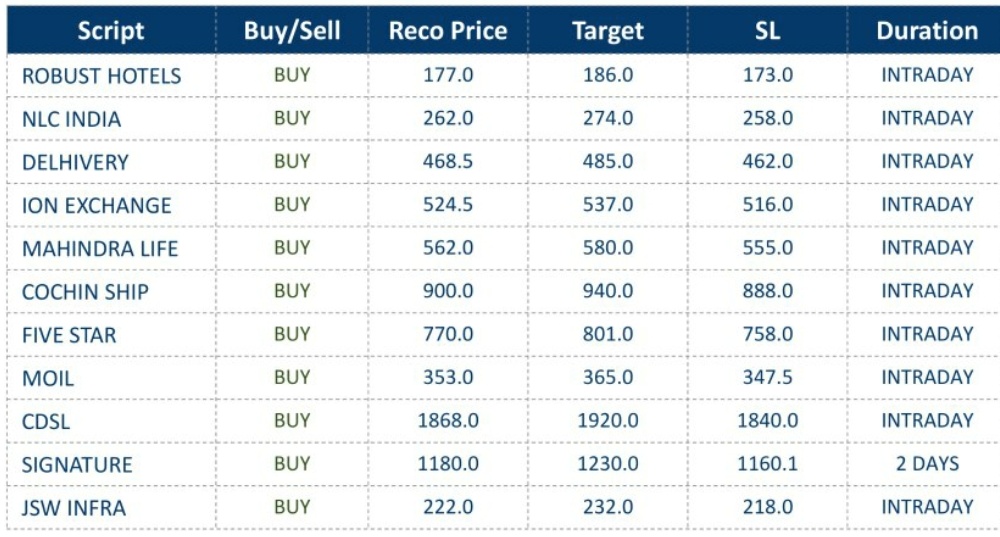

અમદાવાદ, 5 ફેબ્રુઆરીઃ વિવિધ બ્રોકરેજ હાઉસ, ફંડ હાઉસ અને માર્કેટ નિષ્ણાતો દ્વારા ઇન્ટ્રા-ડે ટ્રેડ માટે વોચ લિસ્ટ આપવામાં આવ્યું છે. તે પૈકી પસંદગીની સ્ક્રીપ્સ રોકાણકારોના અભ્યાસ માટે અત્રે રજૂ કરીએ છીએ.

Citi on Adani Ports: Maintain Buy on Company, raise target price at Rs 1564/sh (Positive)

Citi on Indigo: Maintain Buy on Company, raise target price at Rs 3700/sh (Positive)

MS on Indigo: Maintain Overweight on Company, raise target price at Rs 4145/sh (Positive)

GS on Indigo: Maintain Buy on Company, raise target price at Rs 3500/sh (Positive)

Citi on Delhivery: Maintain Buy on Company, raise target price at Rs 550/sh (Positive)

Macquarie on Tata Motors: Maintain Outperform on Company, raise target price at Rs 1028/sh (Positive)

Jefferies on Tata Motors: Maintain Buy on Company, raise target price at Rs 1100/sh (Positive)

CLSA on Tata Motors: Maintain Buy on Company, raise target price at Rs 1061/sh (Positive)

Nuvama on Tata Motors: Maintain Hold on Company, raise target price at Rs 960/sh (Positive)

Emkay on Tata Motors: Maintain Add on Company, raise target price at Rs 925/sh (Positive)

GS on Tata Motors: Maintain Buy on Company, raise target price at Rs 960/sh (Positive)

Nomura on State Bank: Maintain Buy on Bank, raise target price at Rs 755/sh (Positive)

Elara on State Bank: Maintain Buy on Bank, raise target price at Rs 758/sh (Positive)

Jefferies on State Bank: Maintain Buy on Bank, target price at Rs 810/sh (Positive)

JP Morgan on State Bank: Maintain Overweight on Bank, target price at Rs 725/sh (Positive)

Jefferies on Torrent Pharma: Maintain Buy on Company, raise target price at Rs 2930/sh (Positive)

CLSA on Torrent Pharma: Maintain Buy on Company, target price at Rs 2800/sh (Positive)

Citi on M&M Fin: Maintain Neutral on Company, target price at Rs 315/sh (Neutral)

Citi on MPhasis: Maintain Sell on Company, target price at Rs 2400/sh (Neutral)

Bernstein on State Bank: Maintain Buy on Bank, target price at Rs 710/sh (Neutral)

Phillip Cap on State Bank: Maintain Buy on Bank, target price at Rs 720/sh (Neutral)

Emkay on State Bank: Maintain Buy on Bank, target price at Rs 750/sh (Neutral)

Citi on State Bank: Maintain Sell on Bank, target price at Rs 600/sh (Neutral)

Macquarie on Auro Pharma: Maintain Outperform on Company, target price at Rs 1300/sh (Neutral)

GS on Devyani: Maintain Buy on Company, target price at Rs 210/sh (Neutral)

Citi on Devyani: Maintain Buy on Company, cut target price at Rs 210/sh (Neutral)

MOSL on UPL: Maintain Buy on Company, cut target price at Rs 530/sh (Neutral)

Citi on UPL: Maintain Buy on Company, cut target price at Rs 650/sh (Neutral)

Jefferies on UPL: Maintain Buy on Company, cut target price at Rs 635/sh (Neutral)

Incred on UPL: Maintain Add on Company, target price at Rs 694/sh (Neutral)

JP Morgan on Torrent Pharma: Maintain Neutral on Company, target price at Rs 2690/sh (Neutral)

Jefferies on Indigo: Maintain Underperform on Company, target price at Rs 2500/sh (Neutral)

MS on LIC Housing: Maintain Equal weight on Company, target price at Rs 495/sh (Neutral)

CLSA on LIC Housing: Downgrade to Outperform on Company, raise target price at Rs 725/Sh (Neutral)

Nuvama on UPL: Downgrade to Reduce on Company, cut target price at Rs 486/Sh (Negative)

DAM on UPL: Maintain Sell on Company, cut target price at Rs 462/sh (Negative)

(Disclaimer: The information provided here is investment advice only. Investing in the markets is subject to risks and please consult your advisor before investing.)

(સ્પષ્ટતા: અત્રેથી આપવામાં આવતી તમામ પ્રકારની માહિતી કોઇપણ પ્રકારે રોકાણ, ટ્રેડીંગ માટેની સલાહ નથી. બજારોમાં રોકાણ જોખમોને આધીન છે અને રોકાણ કરતા પહેલા કૃપા કરીને તમારા સલાહકારની સલાહ લો.)