BROKERS CHOICE: TRENT, COFORGE, HAL, BEL, HINDZINC, VEDANTA, HINDALCO, ICICIBank, NTPC, TataSteel, Crompton, Indigo

AHMEDABAD, 9 DECEMBER: અગ્રણી બ્રોકરેજ હાઉસ તથા ફંડ હાઉસ તરફથી પસંદગીના સ્ટોક્સમાં ખરીદી\ વેચાણ\ હોલ્ડ કરવા માટે ભલામણ કરવામાં આવી છે. તે રોકાણકારોના અભ્યાસ માટે અત્રે રજૂ કરીએ છીએ.

Macquarie on TRENT: Maintain Outperform on Company, target price at Rs 6000/Sh (Positive)

MS on Coforge: Maintain Overweight on Company, target price at Rs 2030/Sh (Positive)

B&K on HAL: Initiate Buy on Company, target price at Rs 5610/Sh (Positive)

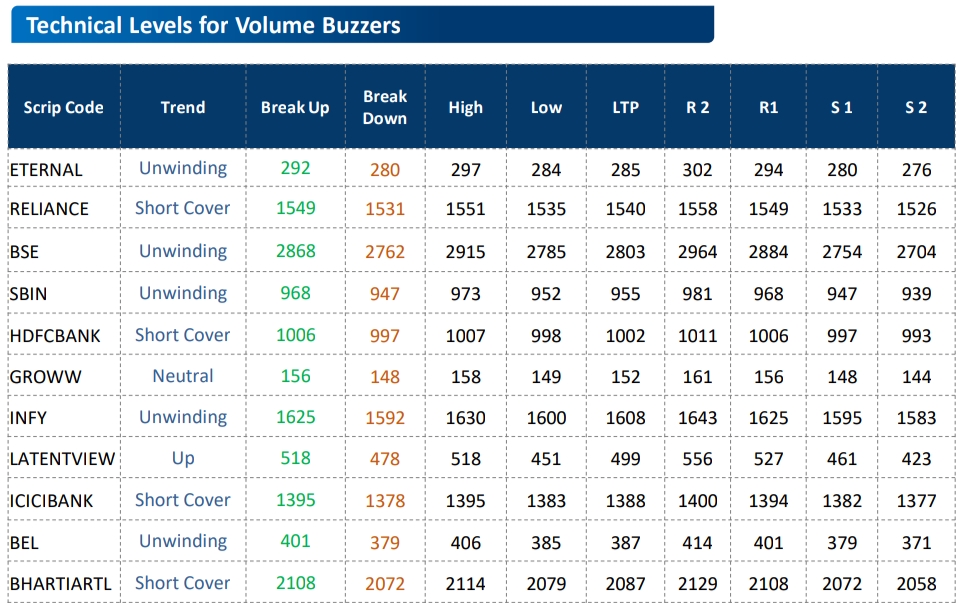

B&K on BEL: Initiate Buy on Company, target price at Rs 513/Sh (Positive)

B&K on Hind Zinc: Initiate Buy on Company, target price at Rs 610/Sh (Positive)

Macquarie on Hotel Sector: Favourable setup with high visibility into sustainable double-digit growth. 12% valuation compression since August has created a good entry point. Pecking order is Lemon Tree, ITC Hotels and Chalet Hotels (Positive)

Citi on Metal stocks: Consensus positive on companies like Vedanta and Hindalco (Positive)

Jefferies on India Strategy: Add Godrej Prop, JSW Energy, AU Bank, Axis Bank and SAMIL in the portfolio (Positive)

Jefferies on India Strategy: Reducing weight ICICI Bank, NTPC, Tata Steel, Crompton and Indigo in the portfolio (Neutral)

Citi on Cement sector: Lack of confidence on demand and pricing, little excitement around the space (Neutral)

Citi on Insurance Sector:ICICI Lombard continues to disappoint with weak growth trends, new-age players like Go Digit and Acko show strong, sustained growth. PB fintech stands to benefit from strength in retail health and digital distribution (Neutral)

Kotak on Banking Sector: Housing loan growth is weak, with public banks outpacing private banks, demand is stronger in larger-ticket loans, while overall growth remains sluggish (Neutral)

BofA on Indigo: Maintain Buy on Company, cut target price at Rs 6600/Sh (Neutral)

Macquarie on Siemens: Maintain Neutral on Company, target price at Rs 3100/Sh (Neutral)

B&K on BDL: Maintain Hold on Company, target price at Rs 1406/Sh (Neutral)

(Disclaimer: The information provided here is investment advice only. Investing in the markets is subject to risks and please consult your advisor before investing.)

(સ્પષ્ટતા: અત્રેથી આપવામાં આવતી તમામ પ્રકારની માહિતી કોઇપણ પ્રકારે રોકાણ/ ટ્રેડીંગ માટેની સલાહ નથી. બજારોમાં રોકાણ જોખમોને આધીન છે અને રોકાણ કરતા પહેલા કૃપા કરીને તમારા સલાહકારની સલાહ લો.)